Used Car Finance

There has been a growing trend among the people to regularly upgrade the cars after they have used for some years. This has helped the used car market to grow. Since the cars are in good condition, the people find it as a wise option to purchase old cars. There are, therefore, many car finance companies that give a loan to buy old cars. There is a wide variety of old cars in the market, so it will not be difficult for the consumers to choose from.

Criteria for the Loan:

The loan or the used car finance can be obtained if you can pay a certain amount of interest. The companies that are reputed, give the buyers a competitive rate of interest. This means that if the rate of interest is low, then there will be lower EMIs for the same tenure. In this way, the borrower can save a lot of money if you consider the entire duration of the loan. The banks usually tend to avoid lending loans for used cars. If they do, they also structure the term which will be beneficial for the borrowers. Mostly in the case of banks, the borrower has to make a 20% down payment. But if you can get the used car finance from a reputed company, then you will get a loan up to 90% of the car’s valuation. This means you have to pay just 10 % as a down payment. The car loan basically can be applied for at least five years. The company also allows the borrower to customize their used car repayment as per their own convenience. They give many innovative options that are for the benefit of the consumers.

Why is Car Finance Beneficial?

- The used car finance is one that lessens the burden on the buyer. The price of the old car is not very less as compared to the new cars. So, the reduced cost is a huge sum of money. Hence the burden to buy the car with cash can be lessened if you take a car loan from a company.

- The installments that you have to pay are easy and can be paid by dividing the amount of loan on a monthly basis. Hence you can buy a car that is quite affordable.

- There are lenders who accept repayment within the tenure of five years but there are many others who do exceed it up to seven years. So, you can do the repayment as per your monthly income. If you are not capable, then you can choose a longer period. It will have a lesser EMI and longer tenure, or you can also choose shorter tenure with a larger EMI.

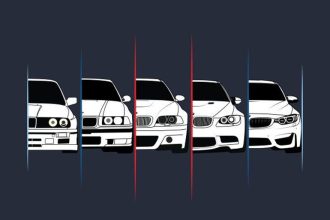

- The most exciting thing is that you can purchase the popular models. You can make a better deal with lesser interest. The processing fees, down payments and other miscellaneous charges, will be compared to the offbeat models. Thus, it becomes easier for you to use the best model car if you wish to.

- The used car finance is of different types and the rate of interest is also very flexible. There are actually four types of loans like the secured loan, the precomputed loan, the unsecured loan, and the simple interest loan. These loans have different interest rates and will be different for every lender. So, you as a borrower have to assess your capability to pay back the amount of loan with interest. You have to do a thorough market research on the available rates of interest before you decide to sign up the loan papers.

The primary benefit of used car finance being allowing the buyer to pay for the car through monthly installments. You do not have to pay it at one time. The buyer has to pay part of the price as down payment while the rest of the amount is financed by the lender.